Looking for the india best stock broker to kickstart your investment journey? Compare top brokerage firms in India, their features, fees, account opening proces

Looking for the india best stock broker to kickstart your investment journey? Compare top brokerage firms in India, their features, fees, account opening process and choose the right one for your trading style. Start investing in the Indian stock market today!

Find Your Match: Choosing the Best Stock Broker in India

Introduction: Navigating the Indian Stock Market Landscape

The Indian stock market, comprised primarily of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), offers a plethora of opportunities for investors seeking to grow their wealth. However, navigating this complex landscape requires a reliable and efficient stock broker. Choosing the right broker is a critical decision that can significantly impact your investment success. Factors such as brokerage fees, trading platforms, research tools, and customer service all play a crucial role.

Understanding Your Investment Needs

Before diving into the list of potential brokers, it’s crucial to define your investment needs and objectives. Consider the following questions:

- What is your investment style? Are you a long-term investor focused on value investing, a short-term trader looking for quick profits, or somewhere in between?

- What types of financial instruments do you want to trade? Are you interested in equities, futures and options (F&O), commodities, currencies, or a combination of these?

- How frequently do you plan to trade? High-frequency traders will need a broker with low brokerage fees and a robust trading platform.

- What is your budget for brokerage fees and other charges? Different brokers have different fee structures, so it’s important to understand the costs involved.

- What level of research and advisory services do you require? Some brokers offer extensive research reports and personalized investment advice, while others focus solely on execution.

Answering these questions will help you narrow down your options and find a broker that aligns with your specific requirements.

Key Features to Consider When Choosing a Stock Broker

Once you understand your investment needs, you can start evaluating different brokers based on the following key features:

Brokerage Fees and Charges

Brokerage fees are the most obvious cost associated with trading. Brokers typically charge either a percentage of the trade value or a fixed fee per trade. Discount brokers usually offer significantly lower brokerage fees compared to full-service brokers. Look for hidden charges such as account maintenance fees, DP charges (depository participant charges), and software fees. Carefully compare the fee structures of different brokers to determine which one offers the best value for your trading volume.

Trading Platform

The trading platform is your primary interface with the stock market. A good trading platform should be user-friendly, reliable, and packed with features such as real-time market data, charting tools, technical indicators, and order management capabilities. Many brokers offer both web-based and mobile trading platforms, allowing you to trade from anywhere at any time. Ensure the platform supports the types of orders you prefer to use, such as market orders, limit orders, and stop-loss orders.

Research and Advisory Services

If you’re a beginner investor or prefer to rely on expert advice, consider choosing a broker that offers comprehensive research and advisory services. These services may include market analysis reports, stock recommendations, portfolio management tools, and personalized investment advice from financial advisors. Keep in mind that these services often come at a premium, so weigh the cost against the value you expect to receive.

Account Opening Process

Opening a demat and trading account should be a straightforward and hassle-free process. Most brokers now offer online account opening, which allows you to complete the entire process from the comfort of your home. Look for brokers that offer clear instructions, prompt customer support, and minimal paperwork.

Customer Service

Reliable customer service is essential in case you encounter any issues or have questions about your account or trading activities. Choose a broker that offers multiple channels for customer support, such as phone, email, and live chat. Check online reviews and ratings to get an idea of the broker’s customer service quality.

Margin and Leverage

Margin and leverage can amplify both your potential profits and losses. Understand the margin requirements and leverage offered by different brokers before using these facilities. Exercise caution when using leverage, as it can significantly increase your risk exposure.

Security

The security of your funds and personal information is paramount. Choose a broker that has robust security measures in place, such as two-factor authentication, data encryption, and regular security audits. Ensure the broker is registered with SEBI and follows all regulatory guidelines.

Top Stock Brokers in India: A Comparative Overview

While naming the absolute india best stock broker is subjective and depends on individual needs, here’s a general overview of some popular options, categorized by their strengths:

Discount Brokers

Discount brokers are known for their low brokerage fees and focus on execution-only services. They are a good option for experienced traders who don’t need extensive research or advisory services.

- Zerodha: A pioneer in the discount brokerage space, Zerodha offers a simple and intuitive trading platform, low brokerage fees, and a wide range of investment options.

- Upstox: Another popular discount broker, Upstox provides a user-friendly trading platform, competitive brokerage fees, and access to various investment products.

- Groww: Groww focuses on simplifying investing for beginners, offering a clean and easy-to-use platform, low brokerage fees, and a wide selection of mutual funds and stocks.

- Angel One: While traditionally a full-service broker, Angel One has adapted to the changing market landscape and now offers competitive discount brokerage plans along with research and advisory services.

Full-Service Brokers

Full-service brokers offer a comprehensive suite of services, including research, advisory, portfolio management, and personalized support. They are a good option for investors who need assistance with their investment decisions.

- HDFC Securities: HDFC Securities is a well-established full-service broker backed by HDFC Bank. It offers a wide range of investment products, research reports, and personalized advisory services.

- ICICI Direct: ICICI Direct is another leading full-service broker affiliated with ICICI Bank. It provides a comprehensive trading platform, research reports, and access to various investment opportunities.

- Kotak Securities: Kotak Securities offers a range of brokerage plans, research reports, and personalized advisory services, backed by the Kotak Mahindra Bank.

- Axis Securities: Axis Securities is the brokerage arm of Axis Bank, offering a wide range of investment options, research reports, and personalized advisory services to its clients.

Factors Beyond Brokerage: Evaluating Hidden Costs and Services

While brokerage is important, don’t neglect other fees. DP charges, transaction charges, and platform usage fees can add up, especially for frequent traders. Also, consider the accessibility of research reports, the quality of customer service, and the availability of educational resources. A broker that offers free access to in-depth market analysis or educational webinars can be a valuable asset, particularly for novice investors.

Opening a Demat and Trading Account

The process of opening a demat and trading account is now largely online and relatively straightforward. You will typically need the following documents:

- Proof of Identity (e.g., Aadhaar card, PAN card)

- Proof of Address (e.g., Aadhaar card, passport, utility bill)

- Bank account details

- PAN card

- Passport-sized photograph

Most brokers offer online KYC (Know Your Customer) verification, which simplifies the account opening process. Once your account is opened, you can start trading in the Indian stock market.

Beyond Stocks: Exploring Other Investment Options Through Your Broker

Many brokers offer access to a variety of investment options beyond just stocks. These can include:

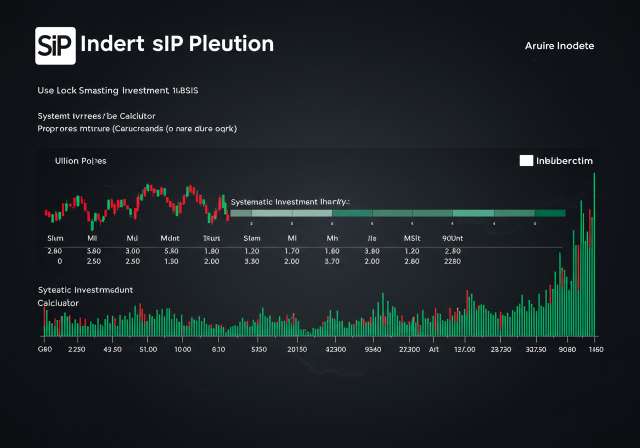

- Mutual Funds: Invest in diversified portfolios managed by professional fund managers. Systematic Investment Plans (SIPs) allow for regular, smaller investments. Consider Equity Linked Savings Schemes (ELSS) for tax benefits under Section 80C of the Income Tax Act.

- Initial Public Offerings (IPOs): Apply for shares of companies going public.

- Bonds and Debentures: Invest in fixed-income securities issued by governments or corporations.

- Commodities: Trade in commodities like gold, silver, and crude oil.

- Currency Derivatives: Trade in currency futures and options.

- National Pension System (NPS): A government-sponsored retirement savings scheme.

- Public Provident Fund (PPF): A long-term savings scheme with tax benefits.

Conclusion: Making an Informed Decision

Choosing the right stock broker is a crucial step in your investment journey. By carefully considering your investment needs, evaluating the key features of different brokers, and comparing their offerings, you can make an informed decision that aligns with your goals. Remember to prioritize factors such as brokerage fees, trading platform, research and advisory services, customer service, and security. With the right broker by your side, you can confidently navigate the Indian stock market and achieve your financial aspirations. Always remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Happy investing!